January 2023 - Recruitment Market Insight

Richard Shelley Public Sector Recruitment, Corportate Social Responsibility, vacancies...

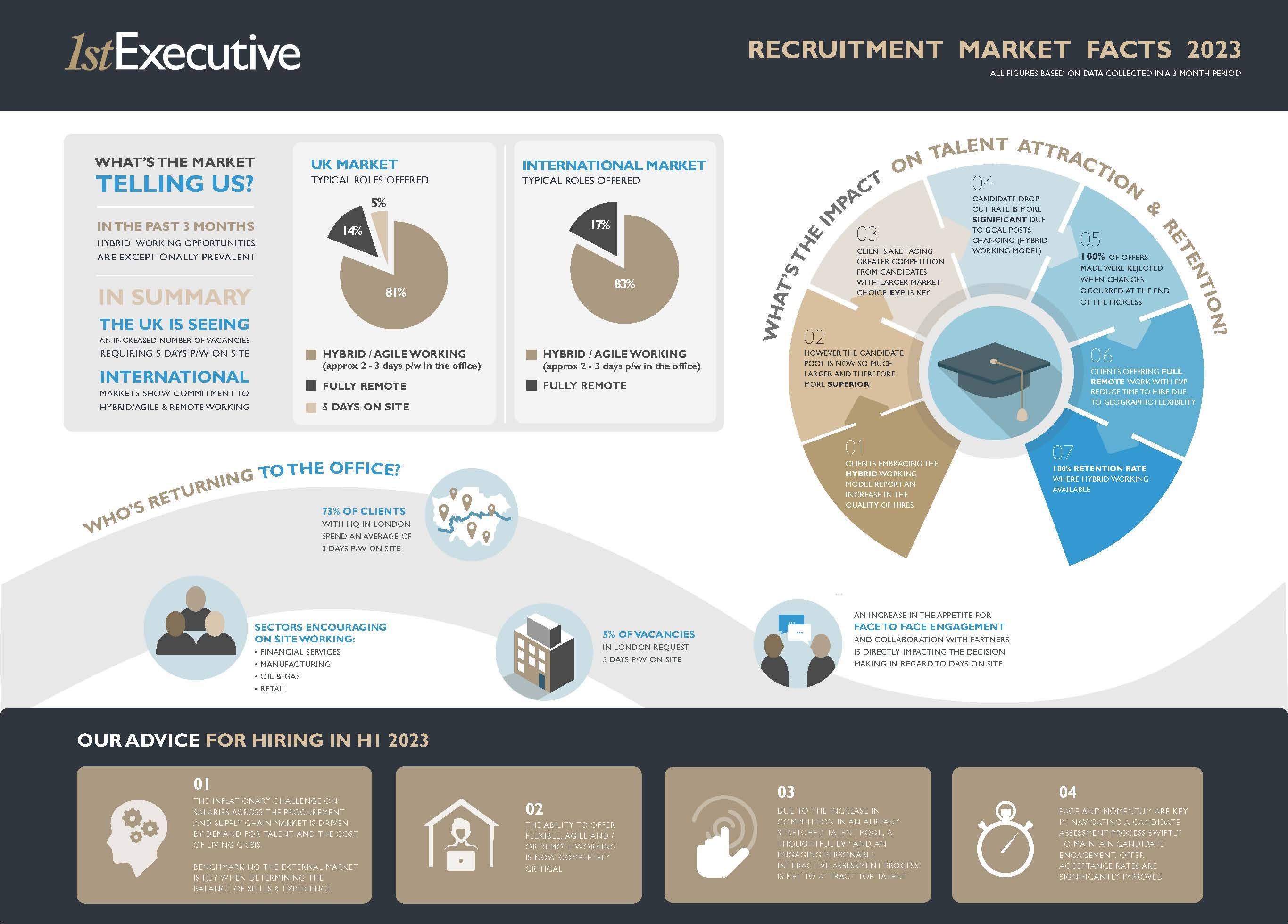

What’s the Market Telling Us?

- In the past 3 months; hybrid/agile working opportunities are the most prevalent in the market

- In the UK market:

- 81% of roles currently offer hybrid/agile working – typically 2 - 3 days p/w in the office

- 14% of roles are fully remote

- 5% of roles are mandated as 5 days p/w on site

- Across our International Markets:

- 83% of roles currently offer hybrid/agile working – typically 2 - 3 days p/w in the office

- 17% of roles are fully remote

- Our 3 month data set indicates that whilst the UK market is demonstrating an increase in the number of vacancies mandating 5 days p/w on site, our international clients are very much committed to their hybrid/agile and remote working policies

Who’s returning to the Office?

- Whilst the landscape in the UK market is relatively consistent in regard to hybrid/agile working our data set indicates that clients in Financial Services, Manufacturing, Oil & Gas and Retail sectors are encouraging their staff to spend a greater proportion of their time in on-site.

- In turn, geography is also having an impact on “time in the office” with our data indicating that 73% of clients with HQ’s in London mandating an average of 3 days p/w on-site

- Across our 3-month data set, only 5% of vacancies in London have mandated 5 days p/w on-site

- A noticeable increase in the appetite for face-to-face engagement with colleagues and suppliers – in recognition of the value of greater and far closer collaboration with Supply Chain partners is directly impacting our clients decision making in regard to the number of days on-site

What’s the impact on Talent Attraction & Retention?

- Clients who have embraced the hybrid/agile working model are typically reporting an increase in the quality of hire made.

- However, this is caveated with the recognition that the competition for talent is now far greater as candidates themselves have access to a far wider pool of clients and opportunities – rather than being limited by geographic constraints

- In turn, clients are ackno

- Where “goal posts” have been changed in regard to the hybrid/agile working model during the course of an interview process our data set shows that the candidate drop out rate is significant – c60%,

- In turn 100% of offers made in the 3 month period were ejected when the change occurs at the end of the process

- Our data also indicates that clients offering fully remote working, with a carefully crafted EVP supporting the marketing of the initiative, are able to reduce their time to hire with geographic flexibility increasing the speed at which they are able to access, and assess, talent

- The 3 months data set identifies a 100% retention rate on new starters where agile/hybrid or remote working is available

Our Advice for hiring in H1 2023:

- It’s no secret that there’s an inflationary challenge on salaries across the Procurement & Supply Chain market all levels – driven in the majority by the demand for talent, as well as the back-drop of the cost of living crises. Careful benchmarking of the external market is key when it comes to determining the balance of skills and experience available at each and every price point.

- The ability to offer flexible, agile and or remote working is critical

- Given increase in competition, across an already stretched talent pool, a thoughtful and considered EVP, as well as an engaging, personable and interactive assessment process plays a key role in attracting top talent

- Pace and momentum, with the ability to navigate a candidate assessment process swiftly is pivotal in maintaining candidate engagement, amidst the backdrop of competition, and increases offer acceptance rates significantly